Bi weekly paycheck tax calculator

The size of your paycheck is also affected by your pay frequency. Ad Compare This Years Top 5 Free Payroll Software.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

All other pay frequency inputs are assumed to.

. Sign Up Today And Join The Team. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Over 900000 Businesses Utilize Our Fast Easy Payroll.

You can calculate your Weekly take home pay based of your Weekly gross income and the tax allowances tax credits. All Services Backed by Tax Guarantee. Free Unbiased Reviews Top Picks.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. It can also be used to help fill steps 3 and 4 of a W-4 form. Learn About Payroll Tax Systems.

You can use the calculator to compare your salaries between 2017 and 2022. Learn About Payroll Tax Systems. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. The calculator is updated with the tax rates of all Canadian provinces and. Ad Compare This Years Top 5 Free Payroll Software.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Sign Up Today And Join The Team. Ad Accurate Payroll With Personalized Customer Service.

Your average tax rate is. Free Unbiased Reviews Top Picks. That means that your net pay will be 37957 per year or 3163 per month.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. That means that your net pay will be 40568 per year or 3381 per month. Computes federal and state tax withholding for.

Over 900000 Businesses Utilize Our Fast Easy Payroll. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Based on the number of withholding allowances claimed on your W-4 Form and the amount of.

The Canada Weekly Tax Calculator is updated for the 202223 tax year. To calculate your federal withholding tax find your tax status on your W-4 Form. All inclusive payroll processing services for small businesses.

Get a free quote today. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Thats where our paycheck calculator comes in. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get a free quote today.

Your average tax rate is. SmartAssets Missouri paycheck calculator shows your hourly and salary income after federal state and local taxes. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Annual Salary To Biweekly Paycheck Conversion Calculator

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

How To Calculate Payroll Taxes Methods Examples More

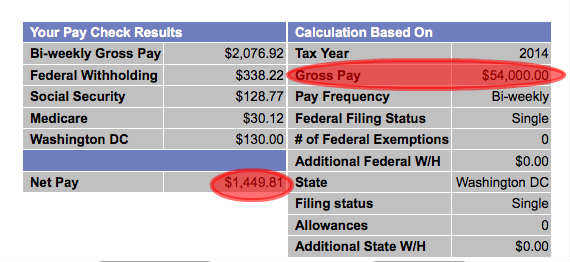

This Is How A Recent Grad Saves 20 000 With 54 000 Salary

How To Calculate Gross Monthly Income With Examples Money Tamer

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

The Pros And Cons Biweekly Vs Semimonthly Payroll

4 Ways To Calculate Annual Salary Wikihow

Paycheck Calculator Take Home Pay Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template